Value-Based Pricing: Maximizing Profits in Machine Manufacturing

Value-based pricing is a game-changer for boosting profitability, especially when market data is scarce. By capturing the true value of products and services, machine manufacturers can optimize their pricing strategies. Check out our infographic for key insights and tips to implement value-based pricing effectively.

Value-Based Pricing: Maximizing Profits in Machine Manufacturing

Value-based pricing is a powerful approach to pricing that directly influences the profitability of a business. In machine manufacturing, this strategy is primarily used when a market-based approach is not feasible due to insufficient market data. Incorporating value-based pricing into a broader pricing strategy allows machine manufacturers to more effectively capture the value of their products and services.

Our infographic provides valuable insights and important aspects to consider when adding value-based pricing to your pricing strategy.

What is Value-Based Pricing?

Value-based pricing is a pricing strategy that establishes prices based on how customers perceive the value of a product or service. Essential to this pricing strategy is a keen understanding of the needs and preferences of customers as well as what they are willing to pay. Unlike cost-plus pricing, which focuses on the expenses involved in production, or competitor-based pricing, which is guided by market norms, value-based pricing aligns the price with the benefits that customers receive from a product or service.

To implement value-based pricing, companies need to have a comprehensive understanding of their target market. This involves collecting and analyzing customer data and conducting market research in order to gauge the value that customers place on products and services. Using this input, businesses can set prices that reflect the unique advantages that their products offer, thus differentiating them from similar products on the market.

Value-based pricing is not only a tool for pricing but also a means for shaping brand perception. By linking prices to certain value drivers, machine manufacturers can strengthen their brand image and foster customer loyalty. This approach is particularly effective for businesses offering unique products, where the perceived value far exceeds the actual cost of production. When implemented correctly, a value-based pricing strategy enables companies to achieve greater profitability, allowing them to capture the full economic potential of their products.

Benefits of Value-Based Pricing

Value-based pricing provides several benefits for OEMs and OPMs. In general, it allows companies to generate more revenue by setting prices based on what customers are willing to pay. This approach often results in higher margins compared to traditional cost-plus pricing, as customers are often receptive to paying premium prices for products that meet their distinct needs or are unique in their functionality. Another key benefit is improved market differentiation. By focusing on features such as quality, performance, and convenience, businesses can set their products apart.

Value-based pricing also drives innovation. To justify higher prices, businesses must consistently enhance their offerings. Instead of viewing products as mere commodities, value-based pricing requires companies to rethink their approach to product creation and development in order to produce unique solutions that customers value. This results in a continual cycle of innovation that can help businesses stay ahead of competitors and meet evolving customer expectations.

Lastly, value-based pricing strengthens customer relationships by aligning price with the tangible and intangible benefits that customers receive. When customers feel they are receiving value commensurate with their investment, their trust in a company deepens. This trust not only leads to repeat business but also enhances customer lifetime value.

With Price Intelligence to Superior Pricing in Machine Manufacturing

In our whitepaper Price Intelligence in Machine Manufacturing, you'll gain necessary knowledge and insights related to price intelligence. Learn how to use data insights to make pricing in the parts business even more effective and profitable.

Key Differences Between Value-Based Pricing and Other Common Pricing Strategies

Value-based pricing differs from cost-plus pricing and market-based pricing in terms of price determinants, customer influence, market differentiation, profitability and innovation incentives.

In value-based pricing, factors such as the complexity of a product, customer needs, preferences, and experiences drive pricing decisions. As a result, businesses using value-based pricing can potentially charge a premium price for their products and at the same time let customer needs guide their approach to innovation.

In contrast, cost-plus pricing focuses on internal costs. Prices are determined by adding a fixed markup to cover costs and ensure profitability, without taking customer perception or demand into consideration. This often results in less market differentiation and can limit potential profitability if customers are willing to pay more. Innovation is not explicitly incentivized, as pricing is driven by cost structures rather than value enhancements, innovation is not as strongly incentivized with this approach. Since cost-plus pricing ignores customer perception and willingness to pay, it also potentially undervalues high-performing products.

Market-based pricing is determined by competitor prices and market conditions. While responsive to external factors, this method does not center customer perceptions of value, offering less opportunity for differentiation and providing fewer incentives for innovation compared to value-based pricing. Market-based pricing falls short when no market intelligence is available to use.

Other pricing strategies such as dynamic pricing and attribute-based pricing can be used to further refine a value-based pricing approach. By adjusting prices in accordance with factors that elevate the value of a product (e.g., seasonal demand, regional fluctuations, and supply chain challenges), dynamic pricing allows businesses to adjust prices in real time.

Price skimming can work alongside a value-based pricing strategy by initially setting a high price to capture maximum profit from early adopters who perceive high value in a product. Over time, as the product becomes more widely available, the price can be gradually lowered to reflect changing customer perceptions. Attribute-based pricing also complements value-based pricing by pricing products according to specific features or attributes that customers value most, ensuring that the price reflects the perceived worth of those key features.

Companies don’t have to rely on a singular approach to pricing for their entire product portfolio. A hybrid approach allows companies to capture value from both cost efficiency and customer perception, providing a more flexible and adaptable pricing strategy for the range of products and services offered. In the machine manufacturing parts business, where portfolios often include a mix of competitive and non-competitive components, experience suggests that blending market-based pricing with value-based pricing creates an effective and balanced pricing strategy.

The Ultimate Guide to Market-Based Parts Pricing

Value-based pricing is an important pricing strategy in machine manufacturing. However, you can only use the full potential of your parts revenue in combination with market-based pricing. Our guide covers everything you need to know about market-based pricing to help your parts business grow.

How Does Value-Based Pricing Work in Machine Manufacturing?

Value-based pricing requires time, research and continuous adaptation. Together with market-based pricing, it helps machine manufacturers to unlock the highest value potential for their products and parts. To implement value-based pricing, machine manufacturers need to develop a deep understanding of their customer base and how they use and benefit from the company’s machinery. In addition to surveys, focus groups and customer interviews, companies can also analyze online discussions surrounding their brand and products and use price optimization tools to determine what products, features and benefits customers find most valuable. This data in turn can help businesses understand the factors that drive customer purchasing decisions, which is crucial for setting a value-based price.

Defining and Measuring Value

Within the value-based pricing framework, monetary value and psychological value play distinct but interconnected roles. Together, these dimensions capture benefits that are both tangible and intangible.

When calculating the perceived value, it’s important to identify the next best alternative available to customers. It doesn’t necessarily have to be a similar product on the market though. A machine manufacturer needs to consider the myriad of ways that customers may be solving the problem behind their product or service. The differential value between your product and the next best option informs the maximum price a customer may be willing to pay.

The financially measurable metrics in economic value are referred to as monetary value. This quantifies direct financial impacts, such as ROI, reduced risk, or avoided costs, anchoring pricing discussions with clear, measurable metrics. In contrast, psychological value focuses on the emotional or subjective aspects of worth, such as status, trust, convenience or a brand’s reputation. While monetary values justify pricing with rational benefits, psychological value justifies premium prices by appealing to feelings and perceptions. Luxury, exclusivity or ease of use can all drive higher willingness to pay. Likewise, context, experience or how information is presented can affect consumer behavior as well.

Assessing Value and Establishing Price Points for Non-Competitive Parts

Below are common steps that OEMs and OPMs take to identify the value of their parts. By segmenting customers, conducting research and analyzing competitors, companies can determine which prices best align with the perceived value of their parts.

- Understand how competitors’ offerings compare in terms of value and pricing.

- The focus should be placed on identifying whether competition exists and what differentiates the part in the market.

- Use both quantitative and qualitative data, including insights from sales and customer support teams. Analyze online reviews, conduct surveys, and hold interviews to gather customer feedback.

- Identify key value drivers by finding out which aspects of the part contributes most to its perceived value. This could be complexity, materials, features, enhancements or support.

- Determine a price ceiling (maximum customers are willing to pay) and a price floor (minimum required to maintain profitability).

- Assign monetary values to product features and characteristics by quantifying the benefits and outcomes delivered to customers.

- Use A/B testing to gain a better understanding of how customers react to different price points.

- Continuously monitor sales performance and customer feedback.

- Adjust pricing as needed to respond to evolving customer perceptions of value.

Analysis Methodologies and Tools

When conducting research and establishing optimal price points, many different methods are used. Some of the most popular ones include:

- Brand equity analysis: Brand equity represents the value associated with a brand. If a company has positive brand equity, this can directly affect the willingness-to-pay threshold of consumers. A company can assess their brand equity by looking at their market share, price premium and mentions of a brand both on- and offline.

- Conjoint analysis: With conjoint analysis, companies use surveys to measure the value that consumers place on individual product or service features. Typically, consumers are shown a series of products or product bundles containing different sets of features. Based on how consumers respond to the different product compositions, companies can determine which features drive purchasing decisions.

- Cost volume price analysis: This method can be used to help determine how optimal a pricing strategy is by evaluating the impact that changes to costs and production volume have on a company’s revenue.

- Economic value estimation: This analysis compares the value of a part to competitors or alternatives and helps to establish how much customers may be ready to pay for the product. When calculating this value, companies need to consider the competitor reference value and the positive, negative and net differentiation value when compared with the competitor.

- Gabor-Granger method: This straightforward method is generally used when launching new products and involves asking potential customers at which price point they would be inclined to purchase it. The data collected can also be used to find out demand elasticity.

- Van Westendorp’s Price Sensitivity Model: Unlike the Gabor Granger method, this model uses multiple questions to indirectly assess willingness to pay amongst consumers. Instead of relying on a single price point, this model aims to assess a range of prices and how they influence customers’ perception of quality and reasonability.

Customer Success Story: Holmer Maschinenbau GmbH

THE CHALLENGE

To define the prices of spare parts, HOLMER used to work with the classic cost-plus approach and a markup factor - like many other machine manufacturers. Additional research to check the price positioning could only be carried out for two to three larger components and involved a lot of effort. The market remained a black box.

"Every now and then, I manually checked individual parts and was able to estimate whether the price made sense or not. But of course, that is only feasible for a fraction of the spare parts and is too time-consuming and inefficient in the long run," explains Christian Läpple, Head of Spare Parts Sales at HOLMER Maschinenbau GmbH.

THE SOLUTION

Thanks to the database of MARKT-PILOT and the resulting potential for price reductions, price increases and monopoly positions (value-based pricing opportunities), spare parts prices can be adjusted to the current market in a fact-based and competitive manner. The first market price research by MARKT-PILOT convinced Christian Läpple right away: Price increase potentials could be realized directly and the Proof Of Value could be amortized by the increase for just three parts alone.

Christian Läpple: "I honestly did not expect the high added value that the software offers us and am more than convinced by the quality. I find it remarkable how quickly and reliably results are delivered and I can only praise the entire team at MARKT-PILOT."

Why Should Machine Manufacturers Adopt Value-Based Pricing?

For machine manufacturers, the urgency to adopt value-based pricing has never been greater. The global marketplace is becoming increasingly competitive, with international competitors leveraging sophisticated pricing strategies to gain an edge. Machine manufacturers can no longer solely rely on traditional pricing models if they want to stay apace in today’s market.

With rising customer expectations, machine manufacturers must understand how to align their pricing strategies with the value their products provide customers. At the same time, technological advancements in areas such as IoT and AI offer powerful tools for data-driven pricing make it possible to adopt more precise and responsive pricing strategies.

As customers place greater emphasis on ROI and long-term value, value-based pricing allows OEMs to position themselves as solution providers instead of merely commodity sellers.

Value-Based Pricing Opportunities in Machine Manufacturing

In a sector where precision, reliability, and innovation are critical, using a value-based pricing model allows machine manufacturers to tailor their B2B pricing strategy in a manner that reflects the distinct benefits of their offerings. Value-based pricing can often be found in companies that offer highly differentiated machinery and solve critical operational challenges for their customers. For instance, companies such as ASML and DMG Mori produce machinery equipped with advanced technology and unique capabilities that come with high price tags. In these cases, customers are willing to pay a premium price for the enhanced productivity, cost savings, and competitive advantage these machines provide.

Below are just a few examples of how value-based pricing can be applied in the machine manufacturing industry:

Spare Parts Where No Competition or Market Data is Available

A significant part of machine manufacturers’ revenue comes from the aftermarket. While, in general, it’s best to use market-based pricing when pricing parts, if there is no competition or data available about market prices, machine manufacturers can highlight the scarcity of the product as well as its importance for the continued productivity of the machinery and business operations.

When applying value-based pricing to parts sales, using an AI-driven software solution like MARKT-PILOT can help to give companies holistic transparency of the parts business, ensuring that this approach is best for the parts in question.

Manufacturers Offering High-End Machines

Offering different lines of machines with varying capabilities and qualities allows machine manufacturers to produce machines that can appeal to various levels of price sensitivity. This, in turn, gives machine manufacturers the opportunity to create machines for customer segments that are cost conscious as well as for more established enterprise customers who may be more interested in machines with advanced features or customization options.

This could be applied, for example, to custom CNC machines or high-end industrial equipment. By focusing on the exceptional quality, precision and advanced features these machines offer, manufacturers can use a higher pricing point to set them apart from standard models.

Machine Manufacturers Creating Highly Specialized, Compliance-Oriented Machines

Machine manufacturers who produce specialized machinery for highly regulated industries, such as pharmaceuticals or medical device manufacturing, may consider employing value-based pricing by focusing on the machine’s ability to ensure compliance with strict industry standards.

By grounding the pricing in the value these machines provide in minimizing regulatory risks, avoiding costly fines, and preventing production delays, machine manufacturers have a great opportunity to increase their profit margin.

Outlook: Value-Based Pricing in Machine Manufacturing

The machine manufacturing industry is under pressure from rising material costs, global competition, and changing customer needs. To stay competitive, manufacturers need pricing strategies that combine market-based and value-based approaches. Market-based pricing ensures transparency and competitiveness by aligning prices with current market trends, while value-based pricing focuses on the unique value of products, especially in areas with little competition.

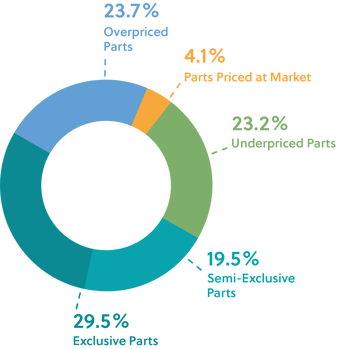

Our research shows that, on average, 29.5% of spare parts are exclusive, and 19.5% are semi-exclusive, meaning there is little to no competition for these parts. These categories create opportunities to use value-based pricing, allowing manufacturers to set prices that reflect the unique benefits and importance of these parts to customers.

In summary, combining value-based and market-based pricing helps manufacturers improve profit margins, build customer trust with transparent pricing, and adapt to a volatile market. This approach allows machine manufacturers to tap into new revenue opportunities and maintain a competitive advantage in a challenging industry.

FAQs

What Is Value-Based Pricing, and How Does It Work in the Machine Manufacturing Industry?

Value-based pricing sets prices based on the value a product or service offers to the customer, rather than focusing on production costs or market rates. It considers factors like unique features, the product's importance to the customer, and the availability of alternatives.

Why Is Value-Based Pricing Important for Machine Manufacturers?

It helps manufacturers maximize the revenue potential of their exclusive or semi-exclusive spare parts by highlighting their unique value and essential role in maintaining machine uptime and operational efficiency.

How Does Value-Based Pricing Differ From Market-Based Pricing?

Market-based pricing sets prices based on market trends and competitors, while value-based pricing focuses on the unique value a product offers to customers. Combining these approaches helps create effective pricing strategies.

What Types of Spare Parts Are Best Suited for Value-Based Pricing?

Our research shows that, on average, 29.5% of spare parts are exclusive, and 19.5% are semi-exclusive. Manufacturers can use market-based pricing to remain competitive for commonly available parts while applying value-based pricing to these exclusive and semi-exclusive parts to capture their full revenue potential

What Are the Main Benefits of Value-Based Pricing for Machine Manufacturers?

Increased profit margins, better alignment with customer needs, improved customer satisfaction, and stronger customer relationships through fair and transparent pricing.

What Challenges Do Manufacturers Face When Implementing Value-Based Pricing?

Challenges include accurately assessing customer value perception, collecting sufficient data to support pricing decisions, and aligning internal processes to ensure consistent value communication and delivery.

What Tools or Technologies Can Support Value-Based Pricing?

Data analytics, customer relationship management (CRM) systems, and pricing solutions like MARKT-PILOT provide valuable insights into customer behavior, market trends, and part exclusivity to support value-based pricing decisions.