"Pricing is the key lever for maintaining competitiveness and protecting margins, especially in the aftermarket!" Nikolas Spatz’ words cut straight to the chase in a recent webinar, but are you pulling that lever effectively? That very question was at the heart of MARKT-PILOT's insightful webinar, presented in close partnership with Horváth & Partners US in late February.

Content:

Entitled "Back to Growth: Optimizing Aftermarket Pricing," the session, expertly led by Tim Geyer, Managing Director at MARKT-PILOT North America, and Nikolas Spatz, Senior Project Manager at Horváth & Partners US, explored actionable strategies for companies aiming to unlock significant growth opportunities by skillfully optimizing aftermarket pricing. The discussion tackled the common pitfalls organizations often stumble upon and provided concrete, implementable solutions for establishing smart pricing strategies, all with the goal of boosting both profitability and competitiveness.

CxOs on a Mission: Top-Line Growth or Bust

A central and recurring theme throughout the online seminar was the untapped potential hidden within aftermarket pricing strategies. The speakers underscored that carefully optimizing pricing in the often-overlooked spare parts business can have a remarkably positive impact on a company's overall profits. They pointed out that in today's rapidly evolving market landscape, pricing stands out as a crucial lever for businesses striving to maintain a competitive edge and fiercely protect their margins.

As Nikolas Spatz succinctly put it, "Pricing is the key lever for maintaining competitiveness and protecting margins, especially in the aftermarket."

As Nikolas Spatz succinctly put it, "Pricing is the key lever for maintaining competitiveness and protecting margins, especially in the aftermarket."

Drawing on the findings of the latest Horváth CxO Study 2024, the online seminar highlighted a critical insight: top-line and price improvements are identified as strategic priorities for CxOs in 2025. This reflects the growing recognition among companies of the urgent need to adapt their existing pricing structures to keep pace with rapidly changing business environments. The study revealed that 60% of the companies interviewed apply an undifferentiated pricing approach with inflexible margins, indicating substantial room for improvement. In fact, it was mentioned that a huge portion of time spent in company board meetings is dedicated to the topic of top-line improvement.

The presenters also illuminated the sheer power of pricing, clearly demonstrating the direct correlation between well-planned price increases and a boost in operating profit. According to the speakers, every dollar gained through price increase pushes revenues and respectively flows directly to the operating profit, assuming all other factors remain constant. They used the example of a fictitious automotive supplier with an aftermarket business unit generating 500 million EUR in revenue with a 12% EBIT margin. The impact was highlighted by a theoretical price increase of 1% at same volume and no cost changes. "Every dollar in price increase is transferred directly to the operating profit," as was emphasized during the presentation.

Pricing Strategies in a Competitive Landscape

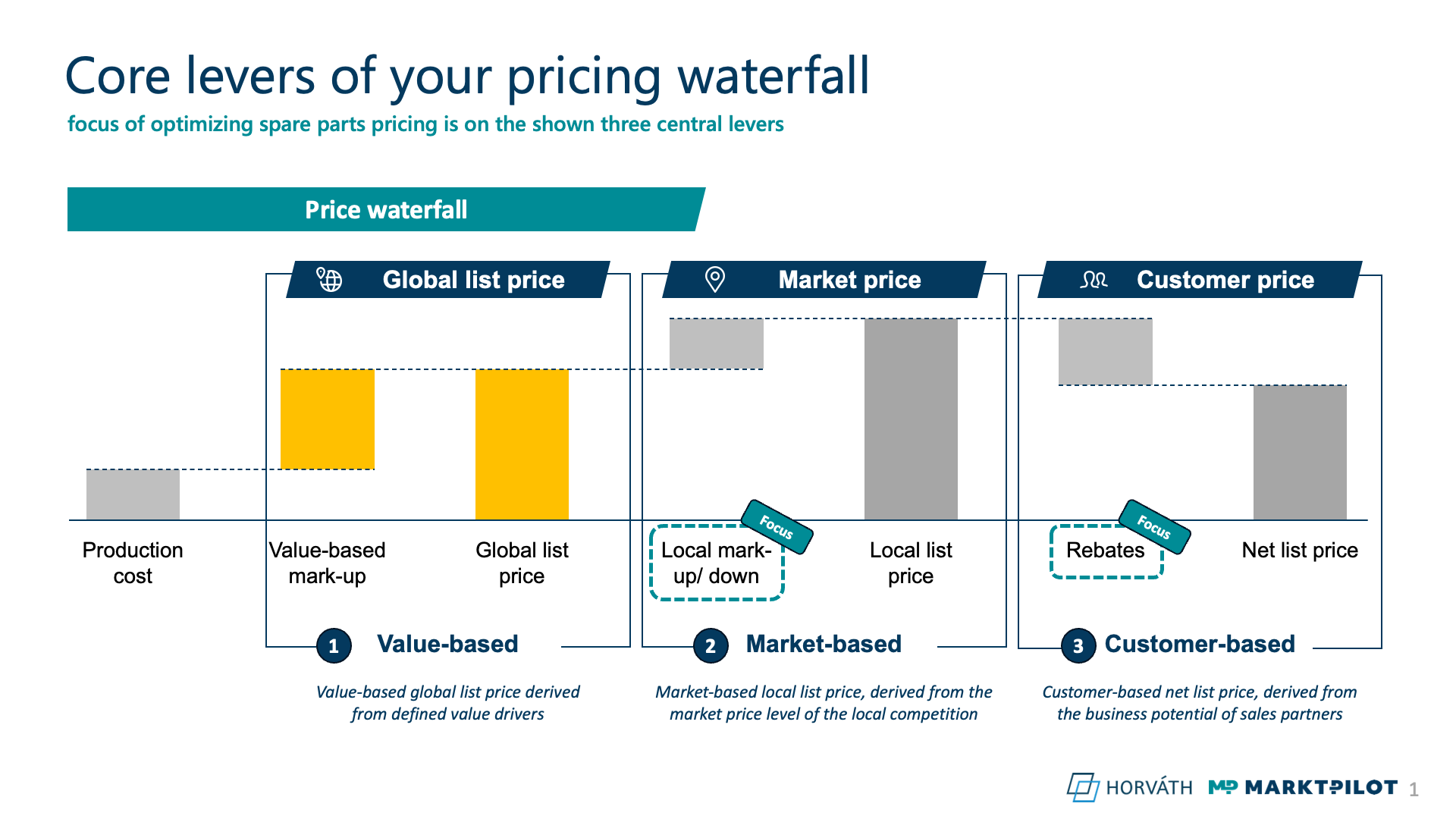

The core of the discussion then shifted to the fundamental levers within the pricing waterfall. The presenters pinpointed three central elements that are crucial for optimizing spare parts pricing: the global list price, local mark-up/down, and customer-based net list price. By strategically focusing on these key elements, companies can ensure that they are employing value-based pricing and effectively capturing realizable margins. The importance of defining value drivers to derive a value-based global list price was also emphasized.

The webinar advocated for a shift towards the adoption of mature pricing models, most notably value-based pricing and competitor pricing, as opposed to relying on traditional, and often outdated, cost-plus approaches. According to Nikolas Spatz, aligning prices with the perceived value and the competitive landscape enables businesses to directly address both volume and margin potential, resulting in a significant boost to EBIT. Spatz highlighted that established price structures are often inconsistent, leading to over- or underpriced parts and lost volume, especially when considering captive parts and commodity parts. This naturally causes missed margin opportunities. Nikolas Spatz stated, "Value- and competition-based pricing are core levers to skim off the realizable margins."

Leveraging AI to Enhance and Support Pricing Decisions

Adding depth to the discussion, the speakers explored how Artificial Intelligence (AI) is revolutionizing informed pricing decisions. They noted that AI-powered solutions have the capability to enhance competitive intelligence gathering, optimize long-tail pricing strategies, and significantly improve overall pricing governance. In fact, the Horváth AI-based Pricing Study 2024 reveals that 95% can imagine using AI for their company or having implemented initial pilots. Furthermore, larger companies have moved from piloting to industrialization of AI in the past two years. Tim Geyer highlighted, "Especially in industries with high product and process complexity, AI-powered solutions bring significant potential."

However, the webinar also addressed usual challenges such as inaccurate cost bases, static pricing logic not equipped for market volatility, limited competitive monitoring, and complex market heterogeneity. It was suggested that AI-powered solutions can effectively tackle these challenges through automated price monitoring of competitive prices, cloud-based pricing operations to allow heavily automated and scalable processes, and rigorous concept alignment. Additionally, AI can improve product master data, which enables a more data-driven approach to long-term pricing.

Case Studies: Learn From Their Wins (and Losses)

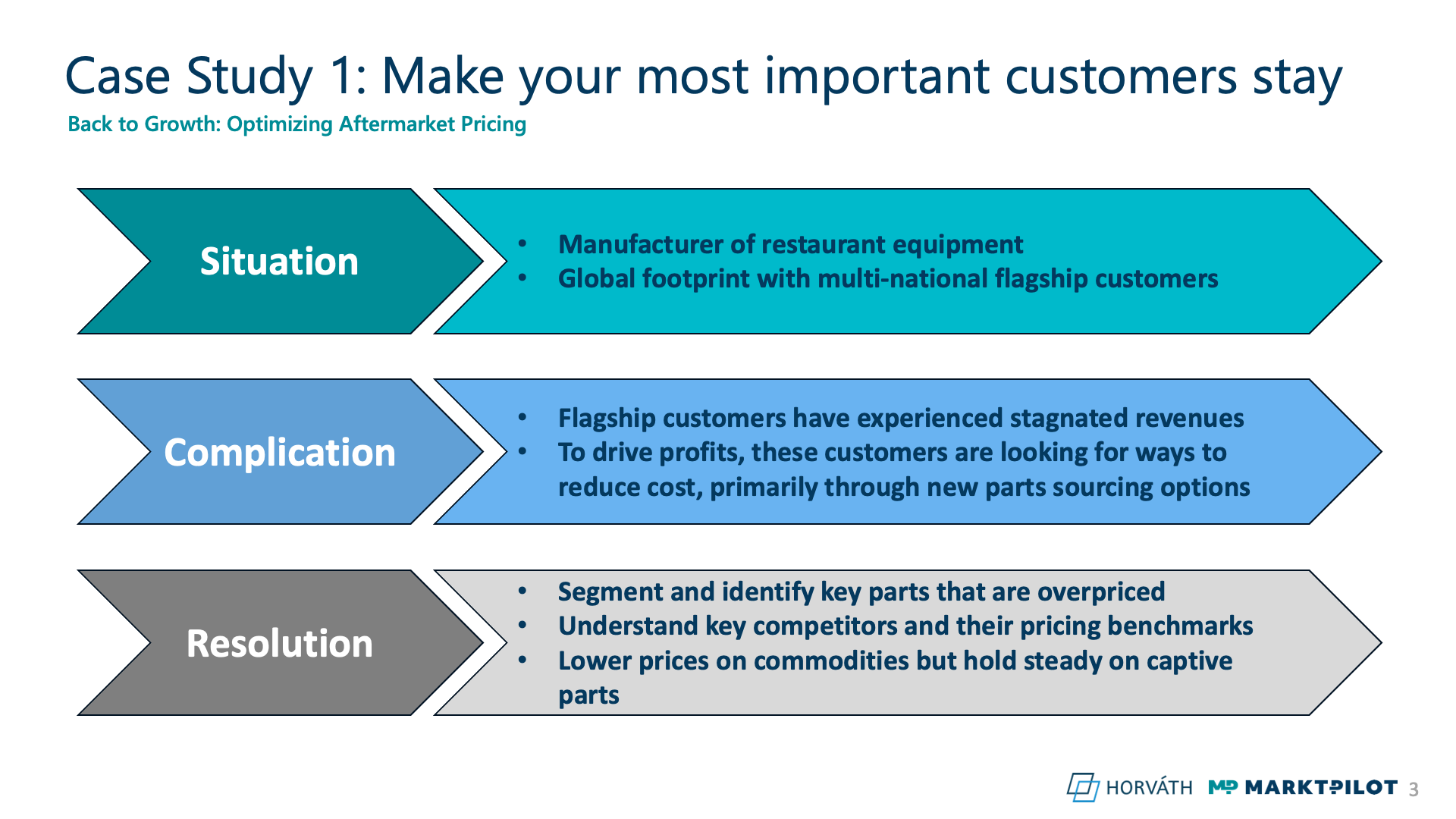

To illustrate the practical application of smart pricing strategies, the webinar highlighted three compelling case studies. The first case study focused on a global manufacturer of restaurant equipment that successfully addressed stagnating revenues among its flagship multi-national customers by strategically segmenting key parts, gaining a deep understanding of competitor pricing, and making informed adjustments to prices on both commodities and captive parts. This strategic approach was critical in retaining their most important customers, who were seeking new parts sourcing options to reduce costs. The key to their success was to lower prices on commodities while holding steady on captive parts. As Tim Geyer mentioned, "Use the market data to understand who the real threats are and strategically price against these threats."

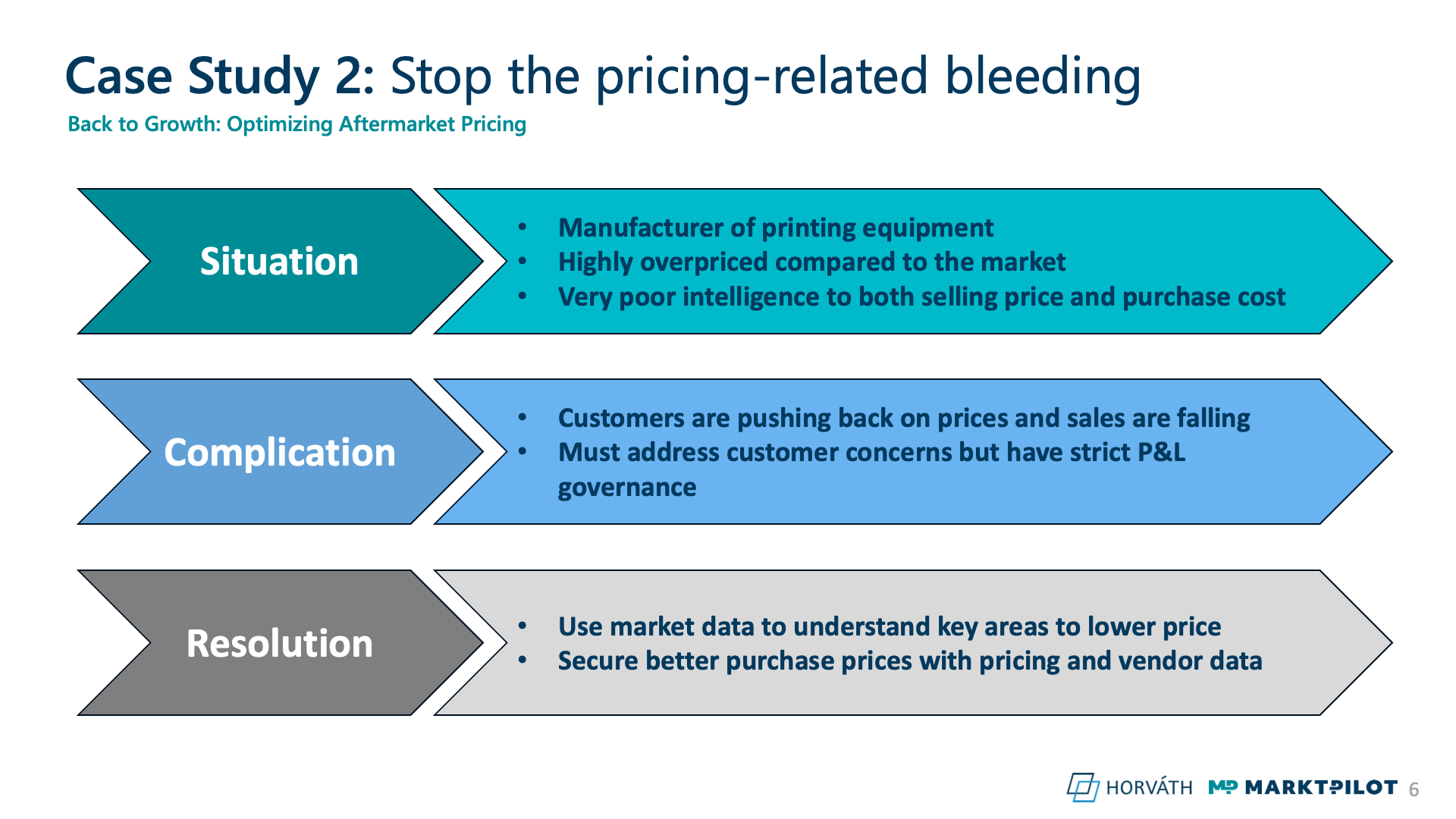

The second case study highlighted a manufacturer of printing equipment that was significantly overpriced when compared to the broader market. With poor intelligence related to both selling prices and purchase costs, sales were falling due to customer pushbacks. By effectively leveraging market data to identify key areas for price reduction and securing more favorable purchase prices with pricing and vendor data, the company successfully addressed pressing customer concerns and improved overall profitability.

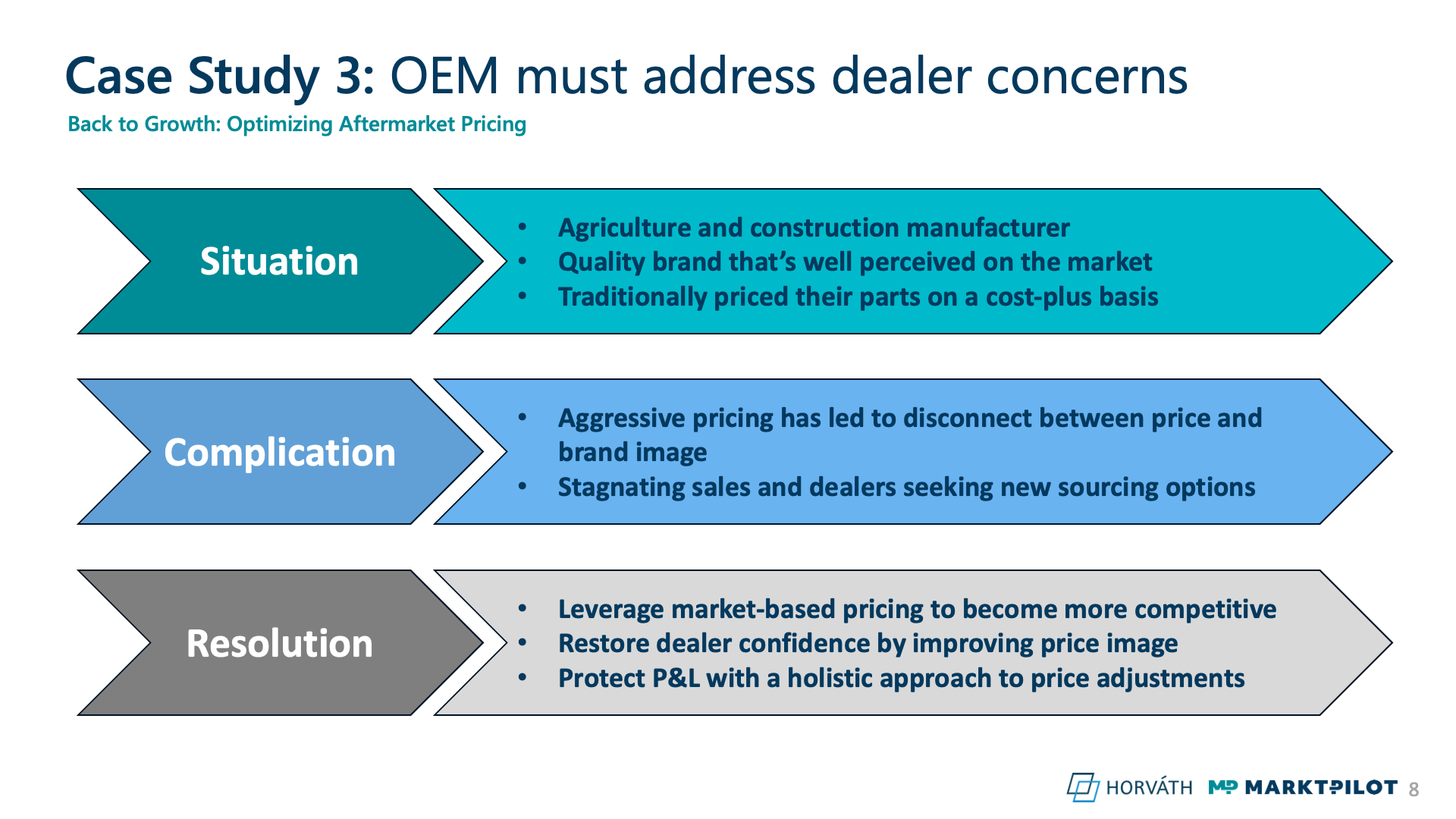

The third and final case study displayed how an agriculture and construction manufacturer effectively addressed concerns raised by dealers by utilizing market-based pricing to become more competitive, rebuilding dealer confidence by improving their price image, and protecting their P&L through a comprehensive approach to pricing. The OEM had traditionally priced their parts on a cost-plus basis, which led to aggressive pricing that did not align with their well-perceived brand image. By leveraging market-based pricing, they were able to regain dealer confidence.

In conclusion, the "Back to Growth: Optimizing Aftermarket Pricing" webinar delivered highly valuable insights into the specific strategies and tools that companies can leverage to fuel growth in the aftermarket sector. By prioritizing core pricing levers, applying value-based pricing principles, and harnessing the capabilities of AI and machine learning, businesses can unlock significant profit potential and maintain a strong, competitive edge.